Max After Tax 401k Contribution 2025

Max After Tax 401k Contribution 2025. Contribution limits employees can put in as much as $23,000 in 401(k) in 2025 ($30,500 for those aged 50 or older). For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025.

The overall 401 (k) limits for employee and employer. This amount is up modestly from 2025, when the individual 401 (k) contribution.

401(k) contribution limits in 2025 increase to $23,000 for most retirement savings accounts or $ 35,500 if you're 50 or older.

The internal revenue service (irs) has announced that contribution limits for 401 (k)s, 403 (b)s, most 457 plans, thrift savings plans (tsps), and.

2025 Max 401k Compensation Brana Brigitte, Irs raises 401k and ira contribution limits for 2025 retirement plans. The 2025 401 (k) individual contribution limit is $23,000, up from $22,500 in 2025.

The Maximum 401(k) Contribution Limit For 2025, The ira catch‑up contribution limit for individuals aged 50 and older remains at $7,500 for 2025. The overall 401 (k) limits for employee and employer.

Annual 401k Contribution 2025 gnni harmony, For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 2025 401 (k) limit of $22,500. The contribution limit for 401 (k)s, 403 (b)s, most 457 plans and the federal government's thrift savings plan is $23,000 for 2025, up from $22,500 in 2025.

401k Limits 2025 Irs Bren Marlie, In 2025, the irs allows you to contribute up to $23,000 to your 401 (k) plan, up from $22,500 in 2025. The internal revenue service (irs) has announced that contribution limits for 401 (k)s, 403 (b)s, most 457 plans, thrift savings plans (tsps), and.

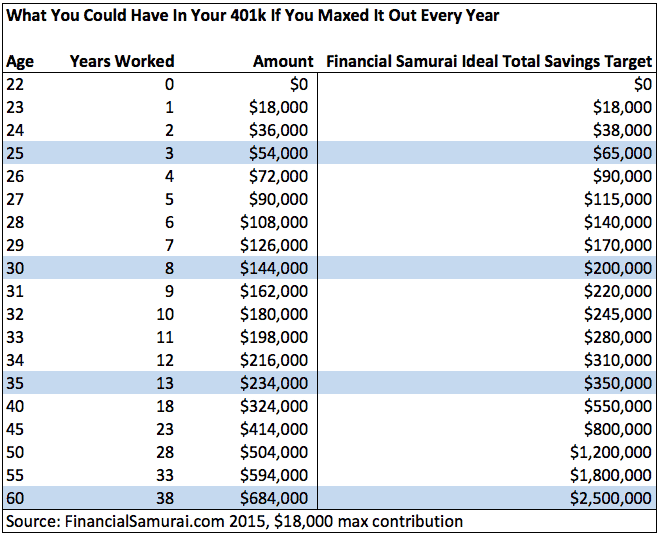

The Maximum 401k Contribution Limit Financial Samurai, What happens if you go over the limit? For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 2025 401 (k) limit of $22,500.

What Is The Maximum 401k Contribution For 2025 Erica Ranique, Going over the 401 (k) contribution limit can lead to costly penalties. The 401(k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older.

Annual 401k Contribution 2025 gnni harmony, 2025 401 (k) contribution limits. 401(k) contribution limits in 2025 increase to $23,000 for most retirement savings accounts or $ 35,500 if you're 50 or older.

Max 401k Contribution 2025 Calculator Reggi Charisse, People under age 50 can generally contribute up to $7,000 per year to their roth iras. 401 (k) contribution limits in 2025 and 2025.

Irs 401k Catch Up Limits 2025 Terra, The 2025 limit was $22,500. The ira catch‑up contribution limit for individuals aged 50 and older remains at $7,500 for 2025.

Employer 401(k) Maximum Contribution Limit 2025 43,500, Similar to roth iras, roth. If you participate in a 401 (k) retirement savings plan at work, your personal contribution limit in 2025 is $23,000.

Contribution limits employees can put in as much as $23,000 in 401(k) in 2025 ($30,500 for those aged 50 or older).